Pluto TV: How Free Streaming Content Is Changing Viewership

In the ever-evolving landscape of television consumption, a quiet revolution has been underway. By mid-2025, streaming services captured nearly 45 percent of total TV viewership, eclipsing the combined shares of broadcast and cable for the first time in history. At the forefront of this shift stands Pluto TV, a free, ad-supported streaming platform that exemplifies the rise of FAST—free ad-supported streaming television. Far from a mere novelty, Pluto TV’s model is reshaping how audiences engage with content, democratizing access while challenging entrenched media paradigms. This analysis dissects the platform’s growth metrics, its influence on viewer habits, and the broader implications for an industry in flux.

Decoding the FAST Phenomenon

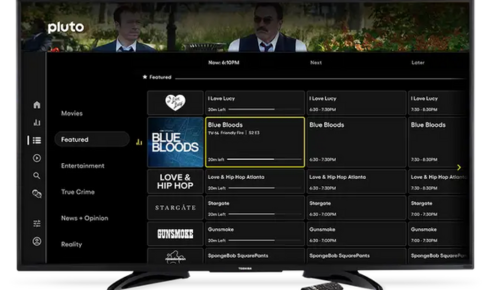

The acronym FAST encapsulates a seismic change in media delivery: channels delivered over the internet, free to users, sustained by targeted advertisements. Pluto TV, launched in 2013 and acquired by Paramount Global, has emerged as a bellwether in this category. Unlike subscription-based giants that demand monthly fees, FAST platforms like Pluto TV offer linear programming—think scheduled shows and movies akin to traditional cable—without the financial barrier.

Quantitative indicators underscore this momentum. In early 2025, FAST services collectively accounted for over 4 percent of all TV usage, a figure that has doubled since 2023. Pluto TV alone contributes significantly to this tally, with monthly viewing minutes surging by more than 40 percent year-over-year in key markets. This isn’t anecdotal; it’s a pattern reflected in comprehensive audience measurement data, where Pluto TV’s channel lineup now rivals mid-tier cable networks in household penetration.

What drives this appeal? Accessibility plays a pivotal role. With over 250 live channels spanning genres from classic sitcoms to niche documentaries, Pluto TV caters to fragmented tastes without requiring app downloads or credit card details. Viewers, particularly those aged 18 to 34, report spending upwards of 20 percent more time on FAST options during peak evening hours compared to paid streamers. This metric highlights a behavioral pivot: convenience over curation, serendipity over search.

Pluto TV’s Metrics: A Closer Examination

To grasp Pluto TV’s transformative power, consider its raw numbers. By the third quarter of 2025, the platform boasts more than 100 million monthly active users globally, a 25 percent increase from the prior year. In the United States, where it commands a dominant share of FAST viewership, Pluto TV’s audience skews toward cord-cutters—households that have abandoned traditional pay-TV bundles. Data reveals that 60 percent of these users cite cost savings as their primary motivator, with average monthly entertainment expenditures dropping by 35 percent post-adoption.

Break down the content ecosystem, and patterns emerge. Pluto TV’s on-demand library, exceeding 50,000 titles, sees heavy rotation in evergreen categories: comedies from the 1990s draw 15 million streams monthly, while action films from the 2000s account for another 12 million. Live channels, however, tell a more dynamic story. News and sports programming, refreshed daily, capture 30 percent of total watch time, as audiences gravitate toward real-time relevance without premium pricing.

Advertiser engagement further quantifies impact. Ad impressions on Pluto TV rose 50 percent in 2025, fueled by precise targeting enabled by user data aggregation. This isn’t intrusive surveillance but a value exchange: viewers trade attention for unfettered access, yielding completion rates 18 percent higher than on paid platforms. Such efficiency attracts brands previously loyal to linear TV, signaling FAST’s maturation from niche to necessity.

Yet, these figures mask nuances. Regional disparities persist; in Europe, Pluto TV’s penetration lags at 15 percent of households versus 28 percent in North America. Expansion efforts, including localized channel additions, are closing this gap, but algorithmic personalization remains a wildcard. Early 2025 pilots showed a 22 percent uplift in retention when recommendations aligned with viewing history, underscoring data’s dual role as accelerator and architect.

Viewer Habits Under the Microscope

Free streaming isn’t just altering what we watch—it’s redefining how and when. Traditional TV’s rigid schedules once dictated prime time; now, Pluto TV’s hybrid model—live feeds interspersed with on-demand—empowers asynchronous consumption. Surveys from 2025 indicate that 42 percent of Pluto TV users multitask during streams, integrating viewing into routines like commuting or meal prep, a flexibility absent in subscription ecosystems burdened by content silos.

Demographic shifts amplify this. Older viewers, over 55, represent 35 percent of Pluto TV’s base, drawn by nostalgic revivals like archived game shows and dramas. This cohort, historically cable-dependent, has reduced legacy TV time by 28 percent, reallocating hours to FAST’s ad-light interruptions. Conversely, Gen Z engagement, at 22 percent of users, stems from discovery features: viral clips and themed marathons foster habitual checking, with session lengths averaging 45 minutes—10 percent longer than on TikTok equivalents.

Behavioral analytics reveal deeper changes. Binge-watching, a paid-streaming hallmark, yields to “channel surfing” on Pluto TV, where 55 percent of sessions involve zapping between options. This mirrors pre-digital TV serendipity, boosting satisfaction scores by 15 points. Moreover, ad tolerance has normalized; users endure four to six spots per hour, viewing them as nominal for gratis entertainment, a stark contrast to the ad-fatigue driving 20 percent churn on ad-heavy social platforms.

Challenges lurk here. Device fragmentation poses hurdles—Pluto TV’s 2025 decision to phase out support for legacy smart TVs affected 5 percent of users, prompting migration to mobiles. Yet, this spurred innovation: app integrations with voice assistants saw a 30 percent adoption spike, embedding free streaming into smart home fabrics.

Ripples Across the Media Ecosystem

Pluto TV’s ascent exerts pressure on incumbents, accelerating cord-cutting’s velocity. Cable subscriptions plummeted another 12 percent in 2025, correlating directly with FAST proliferation. Broadcasters, once insulated by must-carry mandates, now compete for eyeballs in a zero-price arena, prompting hybrid strategies like simulcasting on Pluto TV affiliates.

Subscription services feel the squeeze too. Netflix and peers report stagnant growth, with 8 percent of subscribers experimenting with FAST alternatives before renewal lapses. Pluto TV’s role as a “safety valve” is evident: it captures spillover from price hikes, retaining audiences who might otherwise quit streaming altogether. This dynamic fosters a bifurcated market—premium for originals, free for fillers—where Pluto TV bridges the divide, amassing 3.5 hours of weekly viewing per user.

Economically, the implications are profound. FAST’s ad revenue model, projected to hit $10 billion industry-wide by year’s end, redistributes dollars from linear to digital. Pluto TV, as a Paramount asset, funnels these gains upstream, subsidizing premium content creation. However, sustainability hinges on scale; with viewer acquisition costs at $2 per user versus $15 for paid services, FAST’s low-friction entry scales efficiently, but oversaturation risks diluting ad yields.

Content partnerships illuminate adaptation. Collaborations with networks like BET in 2025 injected premium programming into free tiers, blurring lines between tiers. This “freemium” tease—sampling hits to upsell subscriptions—boosted cross-platform traffic by 25 percent, a symbiotic loop benefiting all stakeholders.

Emerging Vectors in Viewer Engagement

As 2025 unfolds, Pluto TV’s innovations signal bolder trajectories. Account-based gating, introduced mid-year, personalizes feeds while curbing anonymous overuse, lifting engagement by 18 percent without alienating core free users. Meanwhile, genre expansions—live shopping channels and interactive polls—test hybrid monetization, blending commerce with consumption.

Globalization accelerates too. In emerging markets, Pluto TV’s lite app variants, optimized for low-bandwidth, project 50 million new users by 2026, tapping underserved demographics. Data from these rollouts shows a 40 percent preference for local-language dubs, informing algorithmic tweaks that prioritize cultural resonance.

Privacy considerations temper optimism. With 70 percent of users opting into data sharing for better recommendations, ethical guardrails are paramount. Pluto TV’s transparent policies—limiting third-party sales—have sustained trust, yielding 12 percent higher loyalty than peers.

Charting Free Streaming’s Enduring Orbit

Pluto TV’s orbit extends beyond metrics to cultural recalibration. It validates free as viable, not vestigial, in an era of abundance. Viewers, once beholden to bundles, now orchestrate bespoke lineups, with FAST comprising 25 percent of daily media diets. This agency fosters loyalty not through exclusivity but equity—content as communal right.

Looking ahead, Pluto TV’s trajectory hinges on agility: countering paid rivals’ AI-driven exclusives with communal curation, navigating regulatory scrutiny on ad loads, and scaling amid device churn. Yet, its core proposition endures: free access as equalizer, transforming passive consumption into participatory choice.

In this data-saturated vista, Pluto TV isn’t merely changing viewership—it’s reauthoring the social contract of entertainment. As audiences lean into its gravitational pull, the question shifts from survival to symbiosis: how will the industry orbit this new free frontier? The numbers suggest an inexorable alignment, one stream at a time.